Partnering With Us

Evolution of the trust industry

The evolution of the trust industry poses meaningful challenges for trust companies:

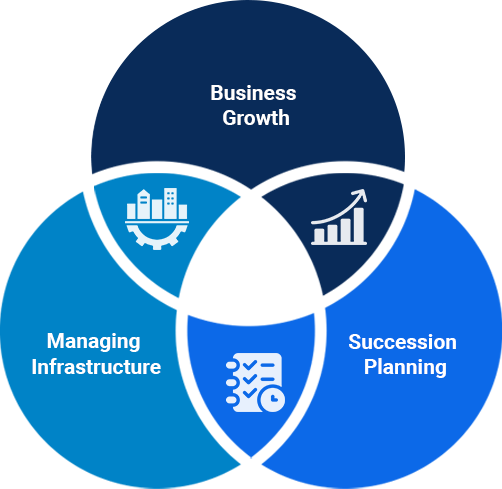

Business Growth

Challenge

The need for trust services is becoming more prevalent among wealthy individuals/families, requiring trust companies to be adept at navigating complex legal, tax, investment, and regulatory issues.

Experienced trust officers are expected to coordinate sophisticated resources (e.g., wealth planners, fiduciary attorneys, investment advisors) needed to successfully deliver complex fiduciary services.

Key Consideration

Understanding the challenges of growing a trust company includes defining business growth opportunities and ensuring proper resources are available to achieve your goals.

Managing Infrastructure

Challenge

Satisfied clients tend to stay with their financial provider who deliver high-touch service and dynamic reporting, enabling them to easily understand their holistic account activity in ways that make sense to them.

The trust services model must be modern, fast, accurate and similar to what clients expect from consumer-based technology.

Key Consideration

Leveraging comprehensive and cost-effective trust infrastructure (Marketing, Operations, Technology, HR, Finance, Regulatory, Compliance, etc.) is critical towards improving client account onboarding, providing digital sharing, and offering better overall customer service.

Succession Planning

Challenge

Within the next decade, industry experts estimate that a significant percentage of trust leadership will retire, with 1 in 4 firms not having a succession plan.

Key Consideration

Establishing a meaningful business succession/ transition plan will provide peace-of-mind and prevent rushing into a last-minute plan which could be costly.

why partner with ascension?

Our job at Ascension is to assist partner trust companies with achieving their entrepreneurial dream of building a more successful enterprise. Through our partnership approach, we provide growth accelerating resources that promote the underlying value of a trust company’s fiduciary services, while also providing a roadmap towards succession. Our approach is meant to expand a firm’s existing infrastructure and depth of talent, including helping them with administering tax advantaged trusts for high-net-worth clients and supporting multi-generational estate planning.

Ascension offers options for owners, operators, and key executives to partner with us.

Invest

Ascension makes strategic investments in partner trust companies based on aligning our goals with the firm. More importantly, we are committed to preserving the autonomy of every partner trust company who joins Ascension. And even though every firm we support is different, we create an individualized approach for supporting their growth. Ascension’s primary focus is clear… We help our partner trust companies grow and THRIVE.

Grow

At the core of our growth approach is our M&A expertise and capital, which is meant to help partner trust companies identify attractive prospects of their own for expansion. Ascension also empowers our partners with a comprehensive list of growth accelerating resources to help them decide how best to grow their business.

Transition

We provide flexible and unique retirement/succession models for partner trust companies.

Support

Ascension believes it is important for a partner trust company to retain everything related to the firm’s successful customer experience, while at the same time leveraging the infrastructure support offered by Ascension, so as not to detract from the firm’s primary focus and further help to reduce support costs.

Get To Know Ascension

If you are an owner/operator, or anyone else interested in learning more about Ascension, please contact us. We would be happy to have a confidential conversation with you.